How Did This Happen?

California isn’t always good at understanding the limits of what a market will bear. After all, we are in the midst of a mass exodus from the state. California has been losing more residents to other states than it has gained for the past 15 years straight; businesses are leaving as well.

To contend with the probability of over-regulation, the proponents of Prop 64 added a caveat that requires some restraint by the state:

“(c) Regulations issued under this division […] shall mandate only commercially feasible procedures, technology; or other requirements, and shall not unreasonably restrain or inhibit the development of alternative procedures […], nor shall such regulations make compliance unreasonably impracticable.”

Heck, they even went through the trouble of defining what constitutes an unreasonably impracticable regulation:

“(dd) “Unreasonably impracticable” means that the measures necessary to comply with the regulations require such a high investment of risk, money, time, or any other resource or asset, that the operation of a marijuana establishment is not worthy of being carried out in practice by a reasonably prudent business person.”

But putting an actual dollar amount on what constitutes an unreasonably impracticable regulation isn’t easy in a brand-new market. Some of the required support services, such as distributorships, lab testing, tracking, transport and insurance, are facing their own regulatory hurdles to market entry, and both prices and availability of services are far from stable.

Why Is It So Hard To Fix The Regulations?

Many people feel that Prop 64 contains provisions that are anything but reasonable, including a requirement for childproof packaging of flower and enclosed vehicles for deliveries of any size. People have proposed changes or amendments to requirements like this to save costs, but some regulations just can’t be changed by the BCC or the legislature because they were included in the language of Prop 64. California’s cannabis market (and its environment) is thoroughly caught in the cleft stick of Prop 64’s unintended consequences.

At this point, more than a year into the legal recreational market, it’s safe to say that California’s regulations meet the very definition of unreasonably impracticable. If they didn’t, then the illegal market wouldn’t still be thriving. Yes, some would try to skirt under the radar no matter what; but most illegal cannabusinesses would gladly trade that for the opportunity to conduct business without fear of raids.

So why can’t we get this right? Perhaps those in control of the regulations haven’t really had the chance to understand all of the current expenses that go into starting a cannabis business. But the more likely scenario is that there hasn’t been enough time to assess the entire production line. Each state fee, local fee and compliance requirement may seem reasonable on its own, but when combined they’re overwhelming. And since the regulations and laws are created by several different branches and parts of the government, it’s easy to see how one hand may not fully understand what the other is doing.

What Are The Specific Barriers To Market Entry?

Barriers to legal market entry include:

- Application fees

- Licensing costs

- Regulatory compliance costs

- Land purchase or rental (required for application)

- Inspections

- Building costs

- Equipment costs and much more

Even if the state tries to keep these costs down, the regulations themselves can be daunting. For instance, an applicant needs to be in legal possession of their business address when they apply for a license, no matter how many months that process will take.

For most, that means purchasing or paying monthly rent on a facility without knowing how long they will have to wait to profit from it, or even if they can. This is one of the most formidable expenses a burgeoning cannabis business can face – amounting to tens of thousands, or even hundreds of thousands of dollars at risk with no promise of return profit.

Worse, the costs for qualifying real estate are artificially high because less than a quarter of the state’s local governments allow cannabis businesses, and most of those severely limit the number of available licenses and locations. This has driven some cannabusiness applicants to engage in black market sales just to pay rent for legal locations for their applications. In fact, it was a bet that many were taking this past year before the state effectively ended its sanctioning of non-profit collectives.

But getting past this nearly insurmountable hurdle doesn’t make life easier for the average cannabis business. There are huge barriers to remaining in the legal market as well, such as:

- Lack of enforcement against illegal competition

- Extremely high taxes

- Higher production costs and lower sales

- Increased compliance costs as more new regulations are adopted

- Fees and fines for failing to comprehend the hundreds of pages of new regulations

The barriers to entry are of the most immediate concern. If these expenses can’t be met, then there is no option for entering the legal market in the first place. But it’s very difficult to figure out how much these initial costs are. The environmental reviews and regulations required by CEQA can cost nothing to tens of thousands of dollars, and local fees vary by each municipality.

Barriers to Legal Cultivation

Without a legal supply, there’s no legal marijuana market at all. So far, less than 3,000 of the state’s more than 50,000 cannabis cultivators have entered the legal market. This means less available products for consumers, lower quality and higher prices; further driving potential consumers back to black market sources. So it’s vital to get a grip on cultivation hurdles.

None of the expenses of beginning a legal cultivation operation are easily quantified, and when a potential cannabusiness starts the process of moving into the open market, they’ve opened Pandora’s Box; meaning that they don’t know what their final expenses will be, but there’s no going back once they’ve started. This is especially true for cultivators. After all, once they put their address on an application, it’s not like they can grow a crop and fly under the radar in the black market till they qualify. It’s do or die at that point. So, obviously, there’s a lot of hesitation to start the licensing process in the first place.

Often, cultivators will hire a consultant to assess this potential, but this can cost from $5,000 to $30,000 depending on the size of the project. Consultations costs are high because the regulations for cultivation span hundreds of pages in several different sections of enforcement including the CDFA, OSHA, CEQA, and more.

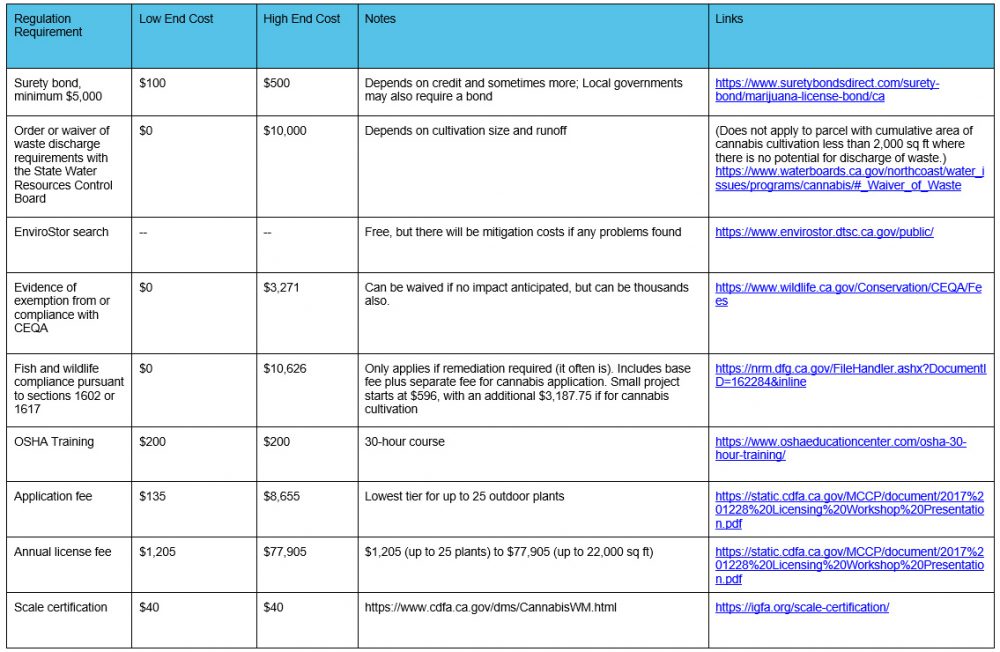

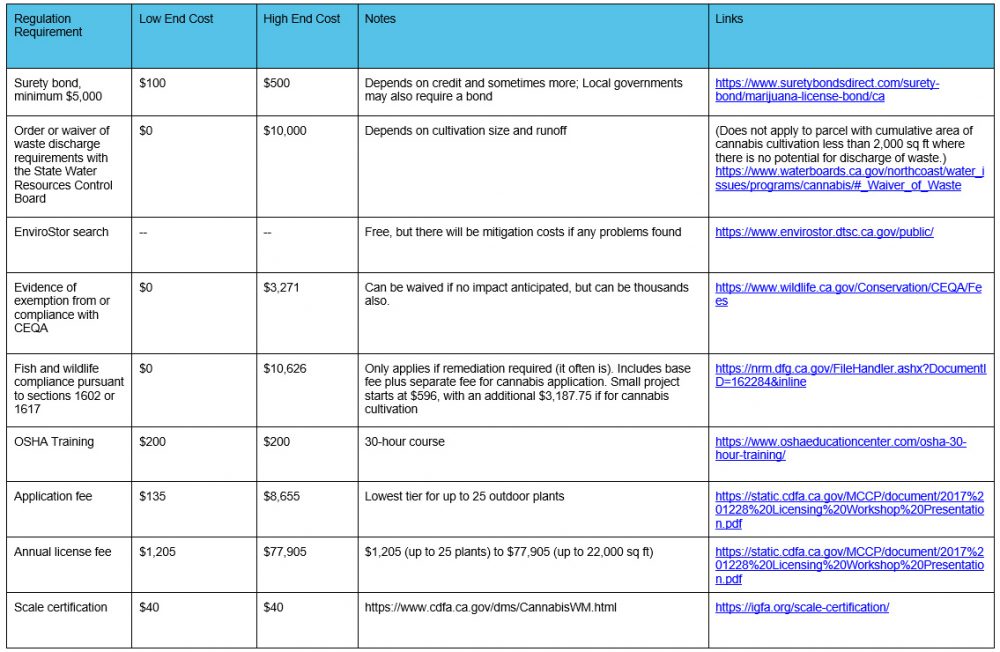

For those who want to wing it, they can try to apply for the smallest license possible for up to 25 plants, but they will be putting thousands at risk at the bare minimum and will likely see no return after their expenses (see table below). To complete an application with the state, a cultivator will need:

The very rare and lucky application may face only about $1,680 worth of administrative and compliance fees at a state level for a mere 25 outdoor plants, but there are additional local fees from roughly $1,000 to tens of thousands depending on the local administration. (Usually between $3,500 and $10,000, excluding use permits and other miscellaneous fees.)

For instance, in San Mateo County, the processing fee for a cannabis license is $6,574. Believe it or not, this is an average fee. Yolo charges $7,814 for a development agreement, Monterey County charges $9,020 in coastal areas and $8,214 for non-coastal areas. Even Humboldt charges a minimum deposit of $3,500.

No Wiggle Room After Local Fees

There are also the standard expenses for starting a grow, from pot purchases and soil amendments to genetics and land purchase or rent. Assuming perfect conditions for this 25 plant, outdoor license, and yields of a pound or so per plant, they might bring in about $600 per average outdoor pound currently for a maximum of $15,000.

So how much of that $15,000 (under perfect conditions) would be left over after every hand held out received their piece of your pie? In a place like the non-coastal zone of Monterey County, which allows outdoor cannabis cultivation, this is where your lost profit will go:

Potential Gross Profit: $15,000

– State License: $1,680 (if you’re lucky)

– Monterey County Use Permit – Cannabis (Non-Coastal Zone): $8,214.27

– Supplies:$1,000 to $3000

– State Cultivation Tax: $231 ($9.25 per pound for 25 pounds)

– Local Cultivation Tax: $1,125*

= Potential Net Profit of $750 to $2,750

Assuming nothing goes wrong, and no environmental compliance fees come up.

*Assumes 3 feet per plant, $15 per square foot. Larger plants and larger yields are very possible in some areas and conditions, but zoning laws will usually prevent very large plants that can be seen over fences.

A black market cultivator growing exactly the same crop only gets around $400 per average-quality outdoor pound right now on the black market (if they can even sell it), but the equation for their expenses looks like this:

Potential Gross Profit: $10,000 – Supplies: $1,000 to $3,000 = Potential Net Profit of $7,000 to $9,000

And of course, the only compliance fee that will come up is code enforcement when caught. Most won’t be. The profit is more like $1,000 per pound or higher if they’re willing to transport it to an illegal state.

More Incentive For Cultivators To Fly Under the Radar

An applicant is required to seek compliance with the State Water Resources Control Board and other agencies before proceeding. As the chart above shows, the lucky applicant won’t face any fees at all if there are no problems, but many will be saddled with thousands, if not tens of thousands of dollars in CEQA compliance costs.

They won’t find out what their potential costs are until the water board lets them know. If the requirements turn out to be beyond their means, they are now on the state’s radar anyway.

Faced with daunting numbers like this, small craft cultivators don’t have a chance. Some municipalities do carry craft cultivation licensing instead, with costs that range from around $1,200 per year to $3,500. But the tax bill in those municipalities remains high.

Barriers to Distribution

The next hurdle for legal cannabis is that a distributor is required to reach the legal market. Much like the post-alcohol prohibition model that created the megalithic American beer distributors of today, Prop 64 forced a middle man onto the California market.

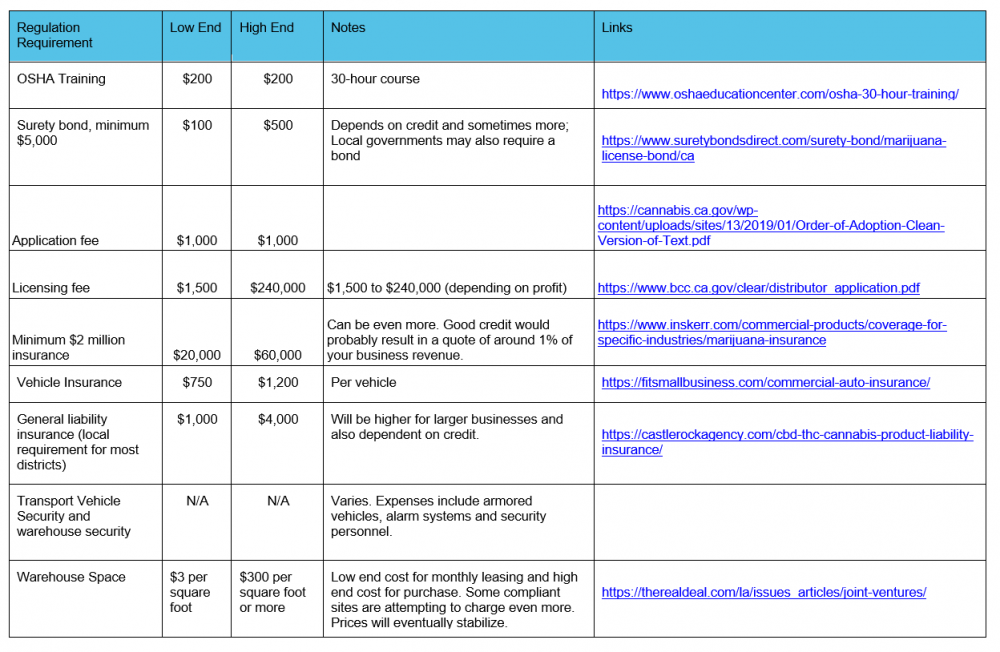

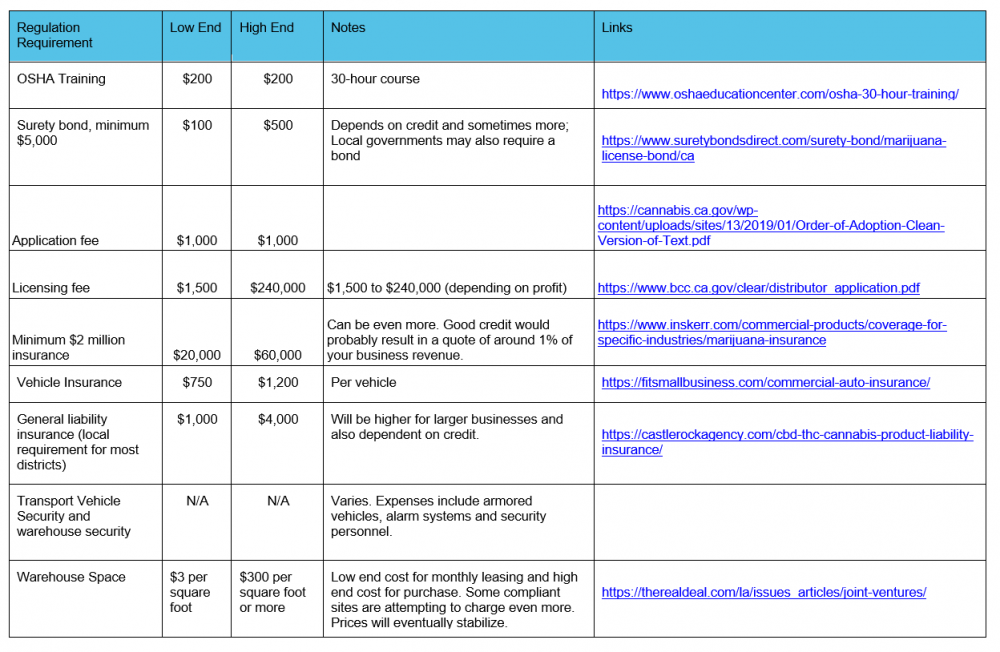

Distributors are making the best of this and carving out important roles for themselves in the market. For instance, they absorb the financial risk of transporting large amounts of cannabis. But this means that they must have state-compliant transport vehicles and a minimum of $2 million in insurance with no less than $1 million per occurrence. They are also responsible for compliance, testing, remediation, and managing state taxes.

This extra layer of management adds a great deal of expense to the product and cuts the profit margin even further for overtaxed growers. The distributors pass on the expenses of regulation and compliance to either the growers or the buyers, and the buyers aren’t very keen to pay that extra bit just yet since black market weed is so easy to find.

Basic Distributor Expenses

In an attempt to cut these expenses, the state allows microbusiness licensees to self-distribute – with additional fees of course. And many cultivators are choosing this option. In fact, only about 25% of the distribution licenses in the state serve the open market. The other 75% of distribution licenses are held by those who transport and market their own product.

Microbusiness

Microbusiness licensing is touted as an option for small craft growers, but the additional expenses and layers of licensing can suck the profit margin right out of smaller grows.

If this distribution option is chosen by a cultivator, the state application fee is $1,000 and the license fee is $5,000 for a business with less than $1 million in revenue. This $6,000 is in addition to any local fees for the extra license types, and many local governments will charge the full separate fee for each of the types of licenses included on the state license.

So, this would not actually be a practical option for an outdoor grower with only 25 plants in a county like San Mateo where the local fees are over $6,000 just for the application. Multiple applications would be needed for the different license tiers, and the grower would be paying more in fees than in potential retail profit before completing their final expenses. A larger license type is needed, and a larger licensing fee would need to be paid.

Microbusinesses Would Have To Go Big, Or Go Home

It’s obvious from these numbers that offering the small craft cultivation license is not going to save small growers. One might think that the cheapest option for entering the market would be to cultivate a few small outdoor plants. That means no additional cost for electricity, no indoor building codes to contend with, and none of the other expenses associated with indoor cultivation. Unfortunately, most local regulations that allow cultivation are too expensive for anything less than a 20,000 sq ft grow.

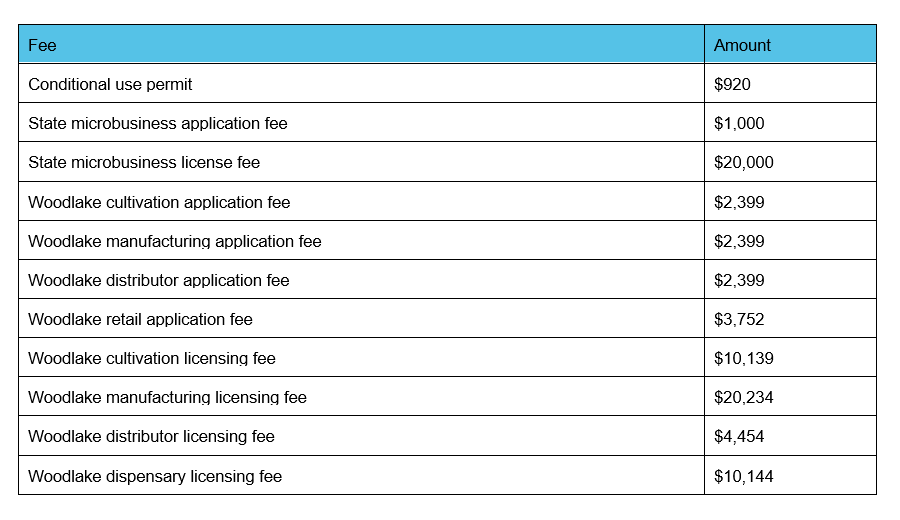

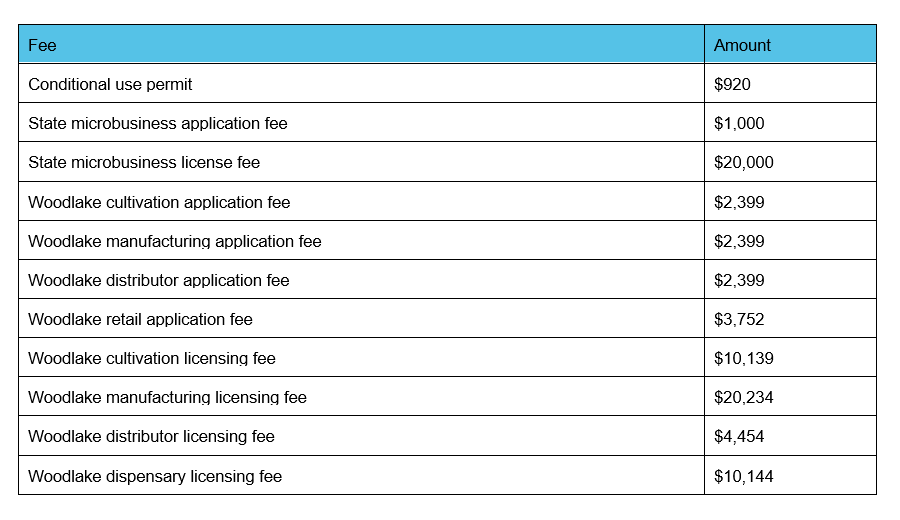

To demonstrate, let’s do the math for a 5,000 sq foot microbusiness cultivation to retail operation. Woodlake, California is one of the few cities in Central California that allow any recreational cannabis activity and has had applications for cultivation. They have very clear fees and provide a small discount in bundled licensing fees for those who choose the microbusiness model, but the smallest cultivation license they offer is 5,000 square feet.

5,000 square feet of indoor cannabis cultivation could yield an average of 40 grams per square foot if managed correctly. At four harvests per year, this would be 160 grams per square foot. 5,000 square feet would yield 800,000 grams, or 1,766 pounds yearly. At $1,200 wholesale per pound of average-quality indoor, this would be $2,119,200. This amount could be much more though, if a cultivator distributed their own product. In order to cultivate, manufacture, distribute and sell their own harvest, the cultivator would need these four levels of licensing:

- Cultivation

- Distribution

- Manufacturing

- Retail

These are the basic application and licensing fees for this setup in Woodlake:

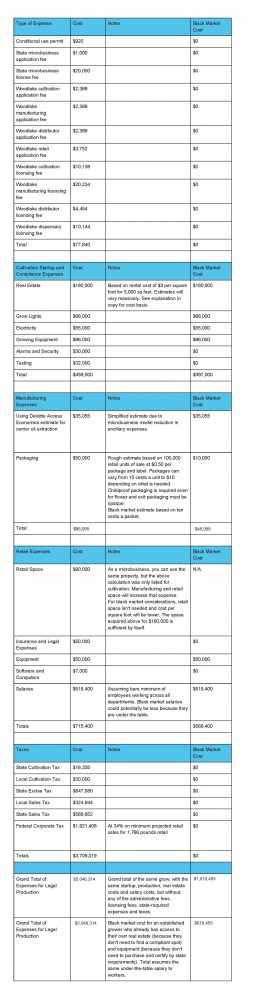

After Woodlake’s $6,745 discount for bundled licenses (15% off the total price), this equals $70,195 in licensing fees alone, not including any other startup costs.

Start-up costs will include, but aren’t limited to:

- Real estate: This can cost up to $300 per square foot due to bidding wars over rare zoned cannabis space. Currently, a compliant 19,000 square foot space in Woodlake is selling for $915,000, coming to about $48 per square foot. If the buyer was lucky enough to find a 5,000 square foot space, that would be $240,000 purchase price. Others are renting ready cultivation spaces for as little as $3 per square foot monthly rent (usually, it’s closer to $10 to $15 per square foot). For the lucky person who found a $3/sq foot space, this would come out to a mere $15,000 per month – a price that would have to be paid while waiting several months for the application process to complete. It’s usually a better idea to purchase the space if it can be found, but this is somewhat unrealistic since properly zoned cannabis property for sale is a difficult find. For purposes of this calculation, $15,000 per month ($180,000 per year) rent will be used with the understanding that monthly rentals can go much, much higher.

- Grow lights: A 1,000 watt light covers roughly six square feet of space. So you’d need about 830 1,000-watt lights to cover a 5,000 square foot grow. At $80 per light, this would be $66,000 for the light setup, assuming you don’t need to hire an electrician to do the work.

- Electricity: $55,000 per year (grow lights, fans, etc. with well-managed electrical use)

- Growing equipment: $96,000 approximately

- Alarms and security: Roughly $30,000

- Testing: Roughly $900 per 50 lb batch (testing prices just went up recently). This will equate to around $32,000 worth of testing per year if the yield is just over 1,700 lbs.

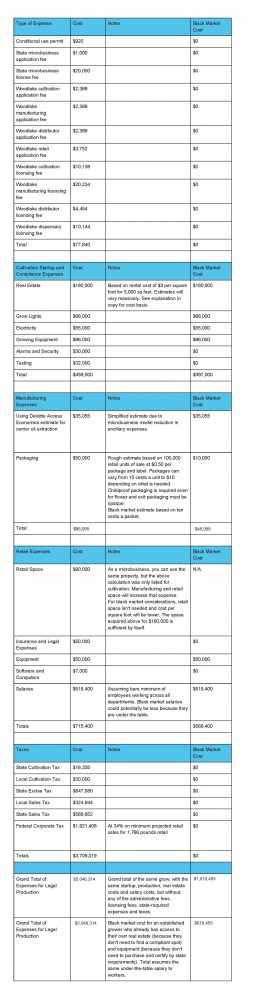

This is a total of $459,000 per year in cultivation operation costs and start-up costs in addition to the permits and fees calculated above. A best-case scenario, this figure assumes that none of the potential regulatory hurdles listed in the initial chart above come into play (such as CEQA compliance issues).

Next comes manufacturing expenses. A microbusiness that just wanted to sell flower could skip these expenses, but concentrates, edibles and vape pens are here to stay. Microbusinesses can only have a Type 6 manufacturing license, so volatile solvents for extract aren’t an option. But that’s OK, there are many ways to get those trichomes.

There isn’t any practical way to estimate these costs. It depends entirely on the type of product being made and the current cost of equipment. A new microbusiness could start with very primitive carrier oil extraction manufacturing like making cannabis chocolates with oil-extracts.

Manufacturing Expenses: Deloitte Access Economics estimates that carrier oil extraction and manufacturing costs around $39.7 per kilogram of flower. This would put the extraction and manufacturing cost for 1,766 pounds of cannabis at $70,110. Assuming you only wanted to manufacture half the harvest and sell the other half as flower, this could be reduced to $35,055.

Packaging Supplies: The BCC shifted the burden of childproof packaging to the dispensaries for now. In a couple of years, this burden moves to the distributors. Either way, this burden is going to be assumed by the microbusiness model. This requirement can be met with childproof exit packaging, and the retailer with 1,766 pounds to sell with probably need around 100,000 units of childproof packaging and exit packaging over the course of the year. You’ll likely be spending around $50,000 a year or so on this if you choose less expensive options.

Other manufacturing expenses will come into play depending on shared use or dedicated facilities, the variety of products and type of equipment used.

Retailers

Now to consider retail operational expenses. This can cost anywhere from $100,000 to $1 million. Among these expenses are:

- Insurance and Legal Expenses: $50,000 (yes, legal expenses are an absolute necessity)

- Retail Space Rental: This can be from around $5,000 to $50,000 or more per month. At a conservative price of $7,500 a month for a very small space (Woodlake isn’t as pricey as LA), this would come to roughly $90,000 per year. Remember that a startup may be paying this expense for months to hold his location open while the application approval processes as well.

- Alarms and Security: Roughly $30,000.

- Equipment: This includes displays, refrigeration, computers, hardware, furniture, etc. $50,000.

- Software and Computers: $7,000 to $10,000.

- Salaries: For a minimal crew of six working at $20/hour with 12-hour-a day operations and probably trading off on the cultivation and manufacturing areas as well, this would be $1,440 per day in salary, not including insurance and other employment costs. If you stayed open 360 days a year, this would be $518,400.

Then the next hurdle is taxes.

- State Cultivation Tax: $9.25 per dry-weight ounce of cannabis flowers, $2.75 per dry-weight ounce of cannabis leaves, and $1.29 per ounce of fresh cannabis plant. Since we are calculating this scenario at poundage of useable flower, $9.25 x 1,766 lbs is $16,335.50.

- Local Cultivation Tax: In Woodlake, this tax is currently $6 per square foot for a total of $30,000 for a 5,000 square foot operation.

- State Excise Tax: There is a 15% excise tax on all cannabis produced, which is charged at the market price and paid by the distributor. If the retail price was $3,200 per pound for indoor, this would be $480 in excise taxes per pound. At 1,766 pounds, this would total $847,680.

- Local Sales Tax: In Woodlake, this tax is currently 5% of gross receipts, and it is charged after the markup from the excise tax, so it’s taxing the tax in a way. The same goes for state sales tax. At $3,200 per pound for 1,766 pounds ($5,651,200) plus the $847,680 in excise taxes, the 5% tax will be roughly $324,944.

- State Sales Tax: In Woodlake, the state sales and use tax is 8.75%. Using the same figures as above for the local tax, this will amount to $568,652.

The total yearly state and local taxes for the 5,000 square foot grow with an average crop commanding $1,200 wholesale and $3,200 retail per pound comes to $1,787,611.50.

Section 280E 🙁

But they’re not paying taxes yet! Cannabusinesses are subject to federal taxes as well, and Section 280E makes it illegal to deduct most of the indirect cannabusiness expenses. While deductions are allowed for “cost of goods sold,” this microbusiness model would be basically charged on the total of its gross receipts.

Some companies use a two-business model – meaning they use one business for direct cannabis sales and the other for indirect business expenses, but a recent Tax Court ruling has made this less likely to work. In the December 2018 decision, Harborside was ordered to pay back millions of business deductions that were used between 2007-2012 through their secondary corporation Patients Mutual Assistance Collective Corp.

The sad truth is that this type of microbusiness owner will likely be paying taxes on nearly all of their gross sales despite their breaking even or losing money. At 34% for the corporate tax bracket up to $10 million, this tax bill will probably be around $2 million as well.

So, the total tax bill for such a business can easily be around $4 million, with another cool million being soaked up in business, regulatory and compliance expenses. If you’re wondering how cannabusinesses are breaking even or losing money despite millions in legal sales, this is why. The deck is simply stacked against them.

Total tally of expenses for 5,000 square foot grow in Woodlake:

This sum is nearly 90% of the projected retail price of $5,651,200 ($3,200 per pound for 1,766 pounds). This sum doesn’t include unexpected, but likely expenses such as OSHA compliance which can amount to tens of thousands of dollars. These are projected rough expenses under ideal conditions and bare minimum projections.

For instance, if the microbusiness were not so lucky with their real estate find, and were forced to pay the more common figure of $10 per square foot instead of $3, the total rental just for the cultivation would be $50,000 per month and $600,000 per year. That would effectively kill the entire profit margin. It’s also a demonstration of why real estate plays such an important role in the licensing process. What may seem affordable for a $5.5 million operation isn’t after considering the other costs of the operation.

There are ways to offset these expenses, such as leasing shelf space to distributors or purchasing property instead of leasing, but finding such a property for purchase would be like finding a winning lottery ticket on the side of the road. And for every bit saved in one area, a piece of administrative red tape can pop up in another. It is unreasonably impracticable for most cannabusinesses to consider compliance with legal market regulations.

So, is the cannabis industry just whining because they have to pay taxes now like everyone else? Or has Atlas justifiably shrugged?

Changes Needed To Assist Legal Market Entry

The state is required by law to lower regulatory costs if they become unreasonably impracticable for businesses to implement. The current lack of interest in the legal market and explosion in the black market make this explicitly clear.

The federal government must also deschedule cannabis or change Section 280E if any businesses are to survive the current taxation and regulation schemes. The current amount being taxed is unconscionable, especially when combined with restrictive and often unnecessary regulations. While the market could attempt to charge more in order to offset these costs, lack of enforcement against black market operations places too much downward pressure on retail prices for the market to bear a major price increase.

The fact that California’s market is surviving at all in this environment is a testament to the intense demand for cannabis products, and the potential tax windfall Californians can receive if they get the regulations right.

It’s a winning bet in the long run.

Sources:

- https://www.waterboards.ca.gov/northcoast/water_issues/programs/cannabis/#_Waiver_of_Waste

- https://www.envirostor.dtsc.ca.gov/public/

- https://www.wildlife.ca.gov/Conservation/CEQA/Fees

- https://nrm.dfg.ca.gov/FileHandler.ashx?DocumentID=162284&inline

- https://www.oshaeducationcenter.com/osha-30-hour-training/

- https://static.cdfa.ca.gov/MCCP/document/2017%201228%20Licensing%20Workshop%20Presentation.pdf

- https://www.cdfa.ca.gov/dms/CannabisWM.html

- https://igfa.org/scale-certification/

- https://planning.smcgov.org/sites/planning.smcgov.org/files/documents/files/Reso_Mjscc0245_wps.pdf

- https://www.hmbreview.com/news/no-applicants-but-new-fees-for-cannabis-licenses/article_7abb2490-639f-11e8-a09f-ef3485cb0df9.html

- https://mjbizdaily.com/growers-western-marijuana-prices-are-down-despite-strong-harvest-high-demand/

- https://www.marijuanaventure.com/california-struggles-to-launch-its-new-distribution-model/

- https://www.quora.com/Could-a-5000-square-foot-cannabis-facility-that-consumes-41-808-kWH-month-run-on-renewable-energy

- https://cannabusinessplans.com/much-cost-grow-cannabis-indoor/

- https://www.odc.gov.au/sites/default/files/modelling-cost-medicinal-cannabis-dae-1609.pdf

- https://www.420property.com

- https://www.cannabisbusinesstimes.com/article/harborside-tax-court-ruling-280e/

- https://cannabusinessplans.com/much-cost-grow-cannabis-indoor/

Deb Tharp is a cannabis activist, consultant, and writer. She began her cannabis activism at the age of 18, helping local candidates campaign door-to-door in the Midwest. Little did she know that the plant would save her husband's life a decade later. After watching him recover 60 pounds to his skeletal frame in a matter of months, she was convinced that the war on weed must end.

She ran for State Assembly in 2010 while completing her bachelor's degree at University of California, Irvine. During her campaign, she managed to bring cannabis legalization to the forefront of the debate. Little more than a year later, she was publicly arrested while gathering signatures for a cannabis ballot initiative in Orange County. She fired back at the county by qualifying Measure CC in Santa Ana under Kandice Hawes' of OC Norml’s expert leadership.

In the following years, she authored, qualified and helped to qualify over a dozen local legalization ballot initiatives across the state while teaching other activists how to do the same.

She currently writes for Nugg, the nation's largest online cannabis marketplace, while pursuing her law degree at Taft Law School and will graduate in 2021.

5 Comments

Mike Harris

Good read

Karen

WOW. This is great information. Thanks for clearly laying out the incredible burden a cannabis operator endures to become a regulated, legal business. It’s amazing anyone will go to these extremes. Most I know who started this process back in 2017 today state they would never have gone to the trouble knowing what they do now. They’re so far into debt and still don’t have an annual license, they feel the state has strangled any success in having a legal marketplace. If things don’t change fast – 2019 will see the industry implode.

Deb Tharp

So true. We are all feeling the urgency. I think that one thing we could do to help make these changes is contact our representatives and give them a copy of this report. The leaders like Bonta and Wood and McGuire are facing an uphill battle convincing other Assemblymembers and Senators to vote in favor of cannabis tax cuts and decreased regulations because it’s difficult to explain the true costs of the regulatory burdens. Most of the legislators have other things on their minds and haven’t really had the time to examine the issue at this level. You can find them here: http://findyourrep.legislature.ca.gov/ and maybe just drop a quick line and a link to the report. Now’s the time since the legislation has just started moving through. Thank you so much for your time and response!

Fred Gardner

Very informative, much thanks!

There’s something tricky about the wording in Prop 64 that you cite:

“Unreasonably impracticable” means that the measures necessary to comply with the regulations require such a high investment of risk, money, time, or any other resource or asset, that the operation of a marijuana establishment is not worthy of being carried out in practice by a reasonably prudent business person.”

The high costs of entry are simply barriers to those without capital. A rich, prudent business person who anticipates high returns can bear the costs. I would like to know who besides Sean Parker and DPA funded Prop 64, i.e., signed off on this wording (and a 15% excise tax on our medicine)?

Deb Tharp

To my understanding Fred, these are the top five pacs that donated (https://ballotpedia.org/California_Proposition_64,_Marijuana_Legalization_(2016)#Support):

YES ON 64 […] $15,906,244.99 (Parker, Weedmaps and tons of individual donors) http://cal-access.sos.ca.gov/Campaign/Committees/Detail.aspx?id=1381808&session=2015&view=received

NEW APPROACH PAC (MPO) $12,349,194.05 (Dr. Bronner’s Magic Soaps, Privateer Holdings, Ameringen, Parker, etc. http://cal-access.sos.ca.gov/Campaign/Committees/Detail.aspx?id=1382525&view=received&session=2015)

CALIFORNIANS FOR SENSIBLE REFORM, SPONSORED BY GHOST MANAGEMENT GROUP, LLC DBA WEEDMAPS $850,000.00 (Weedmaps of course)

MARIJUANA POLICY PROJECT OF CALIFORNIA $777,395.34

CALIFORNIANS FOR RESPONSIBLE MARIJUANA REFORM, SPONSORED BY DRUG POLICY ACTION, YES ON PROP. 64 $1,607,655.35 (DPA and individual investors http://cal-access.sos.ca.gov/Campaign/Committees/Detail.aspx?id=1343793&session=2015&view=received)

ADULT USE CAMPAIGN FOR PROPOSITION 64; $21,468.72

DRUG POLICY ACTION – NON PROFIT 501C4, YES ON PROP. 64 $4,470,000.00

FUND FOR POLICY REFORM (NONPROFIT 501(C)(4)) $6,140,000.00

This was the bulk of the funding, but I wouldn’t jump to blame the individual investors. Most of them didn’t understand Prop 64 enough to anticipate the complications. Heck, even Weedmaps put in a cool mil before realizing that Prop 64 would destroy their business model. Obviously the damage to the company is minimal though, since they to advertise unlicensed dispensaries with no concerns of enforcement from the state. As for the rest, Prop 64 was a long read, and most voters are woefully uninformed. It’s just the sad state of our current direct democracy system. It leads to a lot of messed up laws.